CHUAN: Onchain Unified Alternative-assets Network

Building the world's premier onchain network for alternative real-world assets. Bridging the capital and innovation gap in the digital economy, CHUAN empowers professional investors to directly access quality private credit, digital SME loans, and property/asset financing at scale.

>400M

SEA underbanked

300M

Annual loan app downloads

>$30B

Seller financing gap

$80–100B

Non-bank loans (AU)

$16T

2030 RWA market

Real-World Stories

Ayu – Digital Consumer

Young professional secured a small loan in minutes via a fintech app—while banks would take months.

Only 27% of Indonesian adults have a bank account. Most rely on fintech, which itself faces funding challenges.

Zhang – Amazon Seller

Profitable entrepreneur with vast operational data, yet denied bank loans for lack of collateral/global structure.

>$30B annual funding gap for Chinese cross-border sellers.

Mr. Chan – Global Homebuyer

Internationally banked, but blocked from mortgages abroad by local regulation—non-bank lenders the only option.

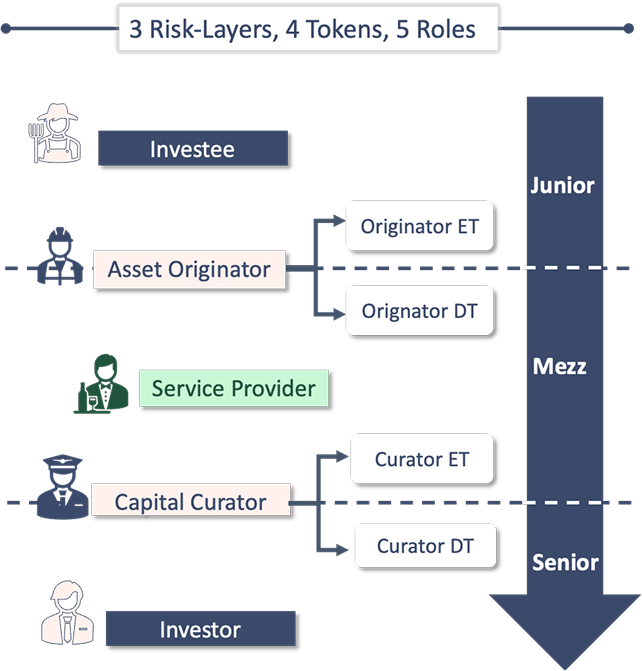

CHUAN's Multi-Layered Onchain Solution

Asset Originators, Capital Curators, and Investors collaborate in a standardized, transparent way—tiered risk, programmatic yield, and onchain open access.

Asset Originator

Provides/creates real-world assets (e.g. loans, receivables), bears first loss (ET holder).

Capital Curator

Invests in debt tokens, manages asset pools, provides market liquidity/support.

Investor

Accesses diversified risk/yield exposure onchain, chooses preferred allocation.

Ready to unlock the future of alternative assets?

CHUAN empowers investors and asset managers to collaborate in the new era of programmable real-world yield. Get started today and experience blockchain-enabled alternative investments.